One of the housekeeping chores investors deal with from time to time is “rebalancing” their portfolios.

It sounds boring, confusing, even unimportant. No wonder so few people ever get around to it! But you really should get around to it, preferably once a year. Here’s why and how.

Why to rebalance your portfolio

How does a portfolio get unbalanced? Consider a game of Monopoly. Each player starts with 25% of the money, but after a few rounds of play, some are richer and some poorer. To get back where you started, you’d have to “rebalance” by taking money from some players and giving it to others.

The percentage allocations in your portfolio today probably look quite different than 12 months ago because some of your holdings have performed better than others. You now have relatively more money in funds/categories that did well and relatively less in funds/categories that didn’t do as well. Rebalancing brings the allocation percentages back to where they started, or at least close.

If you find it counter-intuitive (or even painful!) to sell some of your better performers, that’s understandable. But rebalancing is about risk management. If the allocation percentages you started with were right for you, they’re probably right for you now too.

You might think of it this way: Rebalancing is the epitome of selling high and buying low. You trim holdings that have risen in value and buy shares of funds that have declined.

How to rebalance your portfolio

Although annual rebalancing can be done at any time, rebalancing typically is done at the start of a new calendar year. The process will look different for different investors (depending on the makeup of their portfolios), but here are the major steps.

Step One

Add up the value of your investment portfolio (it’ll help if you use a spreadsheet program such as Excel or Google Sheets). We generally recommend defining your portfolio as the sum of all your investment accounts, but exceptions exist.

For example, don’t include 529-plan college savings. That money will likely be invested in an age-based, automatically rebalanced portfolio.Step Two

Determine how much of your investment portfolio is now in stock funds and how much is in bond funds — both the dollar amount and the percentage of the total portfolio.

Step Three

Revisit your ideal asset allocation. Even if you know what it is, it may be worth your time to go through the Start Here section on our website again. With the passing of another year, perhaps you’re in a different season of life, or maybe your risk tolerance has changed since the last time you did this exercise.

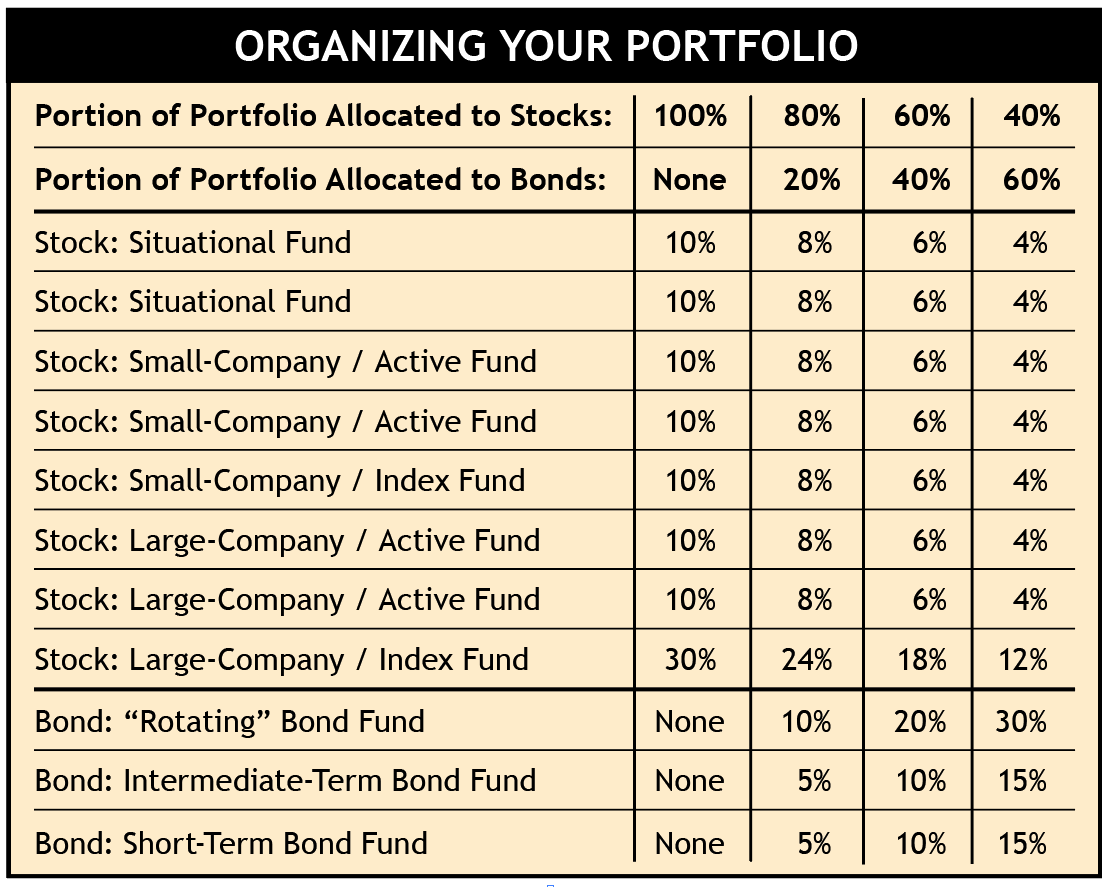

The table below shows the allocations percentages typically used in Fund Upgrading. You can use it to calculate how your current holdings should be allocated. Or, to make the process easier, use SMI’s Upgrading calculator. Input your dollar amount and let the calculator determine the ideal percentage target percentages for each holding. If you’re implementing Just-the-Basics, use our JtB calculator to find your target percentages.

If you’re implementing Just-the-Basics, use our JtB calculator to find your target percentages.

As for SMI’s Premium-level Dynamic Asset Allocation strategy, the regular rebalancing rules don’t apply since DAA doesn’t use a traditional stock/bond approach to asset allocation. Even so, rebalancing DAA is simple. Just reallocate your current holdings so that each of your three funds accounts for about one-third of your DAA portfolio.

Rebalancing SMI’s blended strategy 50-40-10 is more complex, so we suggest using the Excel spreadsheet available here.

Step Four

Bring your current allocations in line with your ideal targets by reducing some of your holdings and using the proceeds to add to others. However, absolute precision when rebalancing isn’t needed. As long as you rebalance to within a few percentage points of your targets, that’s close enough.

Be sure to consider the cost of selling shares of a particular fund, such as a transaction fee fund or one for which you’d incur a short-term trading fee for selling before the end of the required holding period. Incurring too many costs in the pursuit of rebalancing isn’t a good idea.

Further, selling shares in a taxable account may not make sense since that would generate a capital-gains tax liability.

Conclusion

As you can see, rebalancing is part science and part art. Again, don’t get caught up in making the allocations across risk categories perfect. Start with the big picture of getting your overall stock/bond allocation in proper proportion. Then, tweak from there, watching out for any fees that would make a specific change not worth the cost.