SMI’s Just-the-Basics strategy was designed to be the ultimate in simplicity. JtB uses only three stock-based mutual funds (plus one bond fund if your asset allocation calls for it), can be set up in a matter of minutes, and requires attention just once a year for a quick portfolio re-allocation.

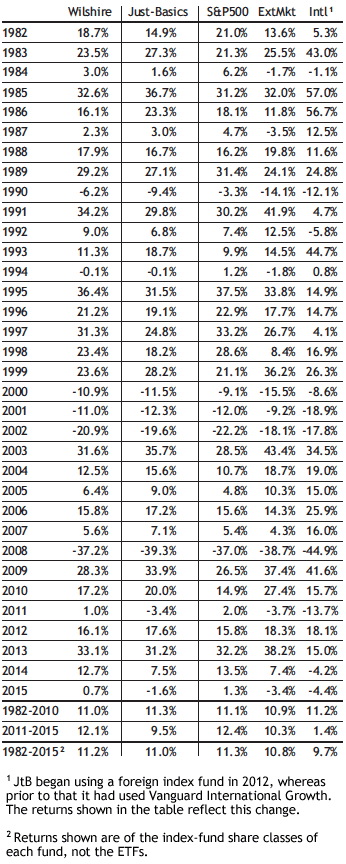

The goal of JtB has always been for its two U.S. index funds to roughly match the return of the full U.S. stock market, while also providing some exposure to foreign stocks through an international fund. Comparing the total returns of the U.S. stock market (Wilshire 5000) and JtB at the bottom of the table, it’s evident that, generally speaking, it has done that over the past three decades.

Three funds instead of one

For a strategy that is billed as the ultimate in simplicity, it may seem odd that JtB uses three stock funds rather than just Vanguard’s Total Stock Market Index fund, which is a proxy for the broad-market Wilshire 5000 index. There are a few reasons for this.

First, the Total Stock Market fund wasn’t introduced until 1992, two years after JtB made its debut in SMI. Thus, initially it wasn’t an option. However, if that were the only reason for using multiple funds, it would be easy enough to switch the strategy and buy only that single fund.

As it is, there are two additional reasons why JtB uses three stock funds. One is that many investors in 401(k) and other company retirement plans don’t have access to a true total-market index-fund option, but they do have access to an S&P 500 index fund (which tracks large-company stock performance) as well as some version of a small-company index fund. If JtB called for a single total-market index fund, many of these readers would likely substitute an S&P 500 index fund, which would give them large-company exposure but nothing else. We think that would be a sub-optimal approach.

SMI has always specifically wanted significant small-company stock exposure within JtB. This desire is based on research that indicates smaller-company stocks have outperformed larger-company stocks over many years. (Although recent research has cast some doubt on the once widely accepted claim of small-stock superiority, at worst it seems that including small stocks does no harm. Other research suggests it may yet offer a net benefit.)

Because of this small-stock effect, SMI not only includes them in JtB, we overweight them slightly relative to the composition of the actual stock market. The overall U.S. market is weighted about 75% large companies and 25% medium-to-smaller companies. By investing equal amounts within JtB in the S&P 500 fund (large stocks) and Extended Market fund (mid-and-small stocks), we’re actually boosting the impact of smaller stocks beyond the weight they carry in the Wilshire 5000 index.

Finally, the addition of foreign stocks is a significant difference between the configuration of SMI’s JtB strategy and simply buying a single U.S. stock-market index fund. Whether the addition of foreign stocks into the equation is a positive or negative is an important question. As we’re about to see, the inclusion of foreign stocks has been largely responsible for most of the variance in returns between JtB and the U.S. stock market in recent years.

Does adding foreign and overweighting smaller companies help or hurt?

Before delving into the numbers, an important caution is required up-front: Don’t put too much emphasis on small performance differences in the table below. Advantages of a few tenths of 1%, such as we see here, can reverse and change perceptions depending on which exact years are being examined.

For example, the first sub-total line at the bottom of the table shows that in terms of overall annualized returns from 1982-2010, International had the best returns (+11.2%) of the three component funds, while Extended Market had the worst (10.9%). Yet if the starting date is altered by only four years, beginning in 1986 rather than 1982 (not shown in the table), the results reverse: Extended Market leads the three while International comes in last.

Indeed, small changes to the parameters of the study can impact our perception quite a bit. We chose to show the 1982-2015 period because 1982 was the first year data was available for all three of JtB’s fund components.

Here’s how we analyze the data in the table. First, look at the 1982-2010 line and notice how, as of five years ago, the performance totals for all five columns are bunched within a remarkably tight range of +10.9% to +11.3%. JtB had a slim lead over the Wilshire 5000 index, and the returns of all three individual fund components were very similar.

Based on that, at the end of 2010 we would have concluded that JtB was working precisely as intended: a slight improvement over the broad market’s rate of return with minimal effort.

However, as the 2011-2015 line shows, that hasn’t been our experience over the past five years. Large-company stocks have dominated the past five years, boosting the S&P 500 returns relative to smaller stocks. And most glaringly, international stocks have turned in dismal performance relative to U.S. stocks during this time, dragging the overall JtB returns down considerably.

The net result of these past five years has been to turn JtB’s slight advantage over the market as of 2010 into a slight disadvantage as of the end of 2015. Without the context of the earlier subtotals (1982-2010), it would be tempting to look at the overall 34-year returns of the three JtB components and conclude that International’s +9.7% performance was too great a drag on the S&P 500 fund’s +11.3% average to be worth keeping foreign stocks in the strategy.

The big question: keep international stocks or not?

Whether or not to include foreign stocks is the big question that jumps out when evaluating JtB’s historical performance. The performance of that foreign component is much more variable from year to year than the two U.S. stock funds. Looking at the returns for the first 29 years of the table (1982-2010), it’s easy to brush aside that volatility based on the fact that foreign’s overall returns were the best of the bunch. But the recent five-year period of significant under-performance by foreign stocks provides some helpful perspective.

There’s no reason to believe that anything has fundamentally changed regarding foreign stocks. They’ve always been more volatile — the year-by-year returns in the first five years of the table are evidence of this issue from the beginning. While the inclusion of foreign stocks has increased the overall volatility of the JtB portfolio in terms of statistical measures like standard deviation, this variability is intentional, as it adds another “marching to the beat of a different drummer” diversification element to the portfolio.

Of more immediate concern is the question of “mean reversion” as it pertains to foreign stocks. That’s a fancy investing term that describes the tendency of an asset class to rally after a period of underperformance (or cool off after a period of superior performance). We can see other periods when foreign stocks have underperformed by a significant margin within our table: 1988-1992 and 1995-1998 are two examples. The question is whether removing foreign stocks now, following a similar five-year period of under-performance, is likely to cause an investor to miss a “bounce back” stretch such as 2002-2007.

Obviously it’s impossible to answer that question since no one knows how foreign stocks will perform in the years ahead. Based on these data, we’re satisfied that the longer-term historical performance of JtB justifies the continued inclusion of foreign stocks. Again, we’d encourage readers not to focus too strongly on a few tenths of a percent here or there, but rather to recognize that JtB, as currently constructed, has — over time — accomplished its long-term goals.

Ultimately, which funds to include is a question that each JtB investor can decide for themselves. JtB was constructed in such a way that it’s easy to modify if an investor so desires. Removing foreign stocks and continuing to allocate evenly between large- and small-company stocks is easily accomplished, as is shifting to using only one Total-Market index fund. Time will tell if such alterations will be better, or just different.