The way stock market returns are typically reported — “The market was up +9.7% last year” — masks the fact that at any point in time it’s normal for some stocks to be faring well while others are languishing. Indexes such as the S&P 500 and Wilshire 5000 include the stocks of companies from every industry and segment of the economy and represent the general performance of “the market” as a whole.

But hidden beneath the surface of the market’s overall performance are strong cross currents, driven by the action of the various industries that collectively make up the economy.

If it were obvious in advance which specific industries, or “sectors,” would enjoy the biggest gains over the next few years, there wouldn’t be any need to diversify. Real life, of course, isn’t so simple. Because it is so difficult to predict which sectors will excel, most investors chart a conservative course of investing in mutual funds that spread their investments among most or all of the various sectors.

Naturally, some of these diversified funds tilt their portfolios more heavily toward some sectors than others — often a key factor in determining which funds fare particularly well or poorly over a specific period. (The fact that different managers in the same risk category allocate differently among sectors is one reason SMI’s Fund Upgrading strategy can add value over time.) But still, the idea of diversified mutual funds is to spread risk by investing across the industry spectrum.

Some investors, however, want to target a portion of their investing toward specific industries. To do this, they rely on “sector” funds — or, increasingly, to indexed ETFs — that track the performance of specific sectors. These special-purpose stock funds limit their investing to a specific segment of the marketplace. Rather than gaining broad diversification, investors in a sector fund buy into a non-diversified portfolio that restricts its reach to a particular industry or investing theme.

When their particular industry is in favor, these funds really shine. But when tough times hit the companies in the industry in which the fund specializes, the portfolio can’t be shifted to favor other types of companies. This lack of flexibility means most sector funds carry higher risk than diversified funds.

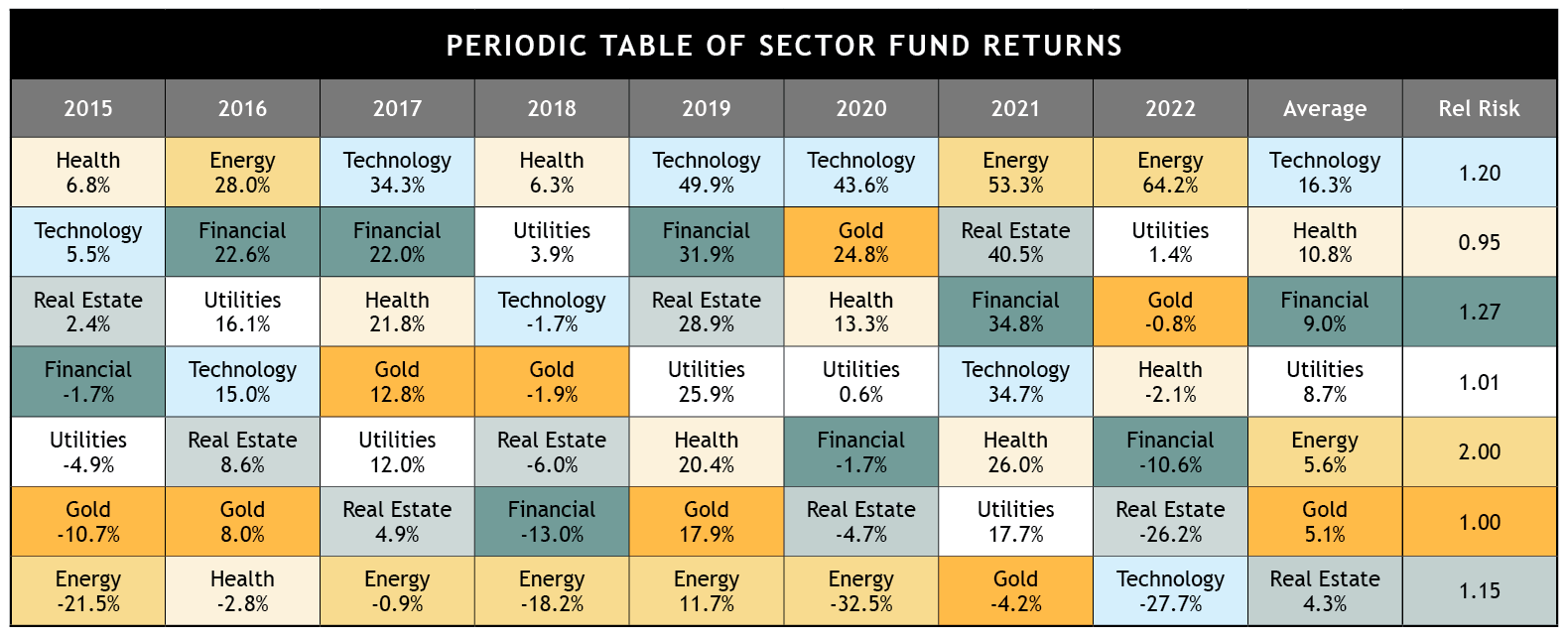

The table below shows the recent performance of funds tracking several of the most prominent industry sectors. The columns are color-coded to show at a glance how the performance of the sectors ebb and flow in relative standing to each other. The two columns on the right display the average performance of each sector over the entire period and the risk taken to achieve that performance. The best performers appear at the top of each column and the worst at the bottom (the relative-risk column is not sorted, but lower relative-risk scores are better).

Click table to enlarge

The chart vividly illustrates the continually changing undercurrents flowing through the stock market. It’s common for one sector to be near the top of the group for a year or two, then be near the bottom soon after, and vice versa. In fact, that’s more the rule than the exception. Each year shown saw at least one of the top three sectors follow its strong performance by landing among the bottom three sectors the very next year!

It’s unusual for a single sector to stay “hot” for a lengthy period. Technology was dominant through most of the recent period, only to fall to the bottom of the pack last year. The opposite was true for Energy, which lagged badly for most of 2015-2020 before vaulting to the front of the pack in 2021-2022.

Unfortunately, many investors sabotage their long-term returns by buying hot sectors at high prices and selling them at low prices. The classic example (which could be repeating today) was during the technology bubble at the end of the 1990s. Sure, some investors got in early and rode the technology investing wave all the way up. But many, many more didn’t buy tech stocks until late in the game, paying huge prices for stocks that were about to fall sharply. That’s fairly typical. Investors repeatedly chase the latest trend, buying what’s been hot over the past few years. But as the table above shows, when a particular sector has been hot for a while, it’s often about to slide to the back of the pack.

A better way to invest in sectors

Thankfully, should you desire to invest in sector funds, there’s a proven way to do so successfully. We’re referring to SMI’s Sector Rotation (SR) strategy, available to SMI Premium members. As this month’s 2022 performance review discusses in more detail, 2022 was a banner year for SR, as it steered us to energy stocks at the end of January. That helped SR gain +18.5% last year while the market fell -19.0%.

If you’re not familiar with the SR strategy, here’s a quick summary of how it works. Each month, Sector Rotation ranks more than 100 sector funds using a modified version of our Upgrading momentum score. We buy the top-rated fund and hold it until it drops out of the top 25% of our sector-fund universe. As soon as it does, we sell it and replace it with the new fund currently atop the SMI sector rankings. We’ve continued this process of monthly monitoring and Upgrading as needed since SR was introduced nearly 20 years ago.

This Sector Rotation approach has been extremely successful. Since its origin in November 2003, SR has an annualized gain of +12.7%, significantly ahead of the S&P 500’s annualized total return of +9.1%. The strategy is simple, requiring attention only once a month, yet it has produced exceptional returns.

Sector Rotation, however, is sufficiently volatile that we caution readers to use it as an “add-on” (rather than core) strategy, limiting it to a maximum of 20% of your total stock allocation.

Conclusion

The main point to take away from this article is the value of diversification. Hitching your cart to one particular sector is usually a bad idea, resulting in frustration and subpar returns. In contrast, buying diversified mutual funds that invest across many sectors offers a convenient and effective way to greatly reduce volatility.

For those with a healthy risk tolerance and a long enough investing time frame, however, sector investing provides an opportunity to earn outstanding returns. Still, even within a disciplined system such as SMI’s Sector Rotation strategy, significant losses will likely occur along the way, and you need to have the conviction to stick with the strategy at those times of maximum disappointment. If you can do that, allocating a small portion of your overall portfolio to sector investing through SMI’s Sector Rotation strategy can provide a powerful boost to your long-term investing results.