[Editor’s note: Fund distributions are unlikely to be as big an event this year as they were in 2021, following the big gains post-COVID. But there are always funds that have sold long-held winning positions, the gains from which must be distributed to investors.]

It’s not unusual for new readers to become concerned when one of our recommended funds suffers what appears to be a severe one-day decline! We assure them there’s no cause for alarm: the drop was caused by a fund distribution.

Let’s review the basics of mutual fund distributions. In the process of investing, mutual funds incur capital gains and losses, and they receive dividend and interest income on their investments. From a tax point of view, all of this is done on behalf of shareholders. It’s as if you owned all the investments outright, and the gains and losses that result are all your personal gains and losses. There are three ways this happens:

A fund invests in stocks that pay dividends. It collects the dividends and pays them out to you periodically.

A fund invests in bonds or other debt securities that pay interest. It pays the interest out periodically.

A fund sells an investment for more than it paid, thereby earning a capital gain. The fund keeps track of such gains (and offsets them against any losses), and pays them out periodically, usually once a year.

All of these payments to you are called distributions, and the amount you receive will depend on how many shares you own. A fund company decides whether to make these periodic distribution payments monthly, quarterly, semiannually, or annually.

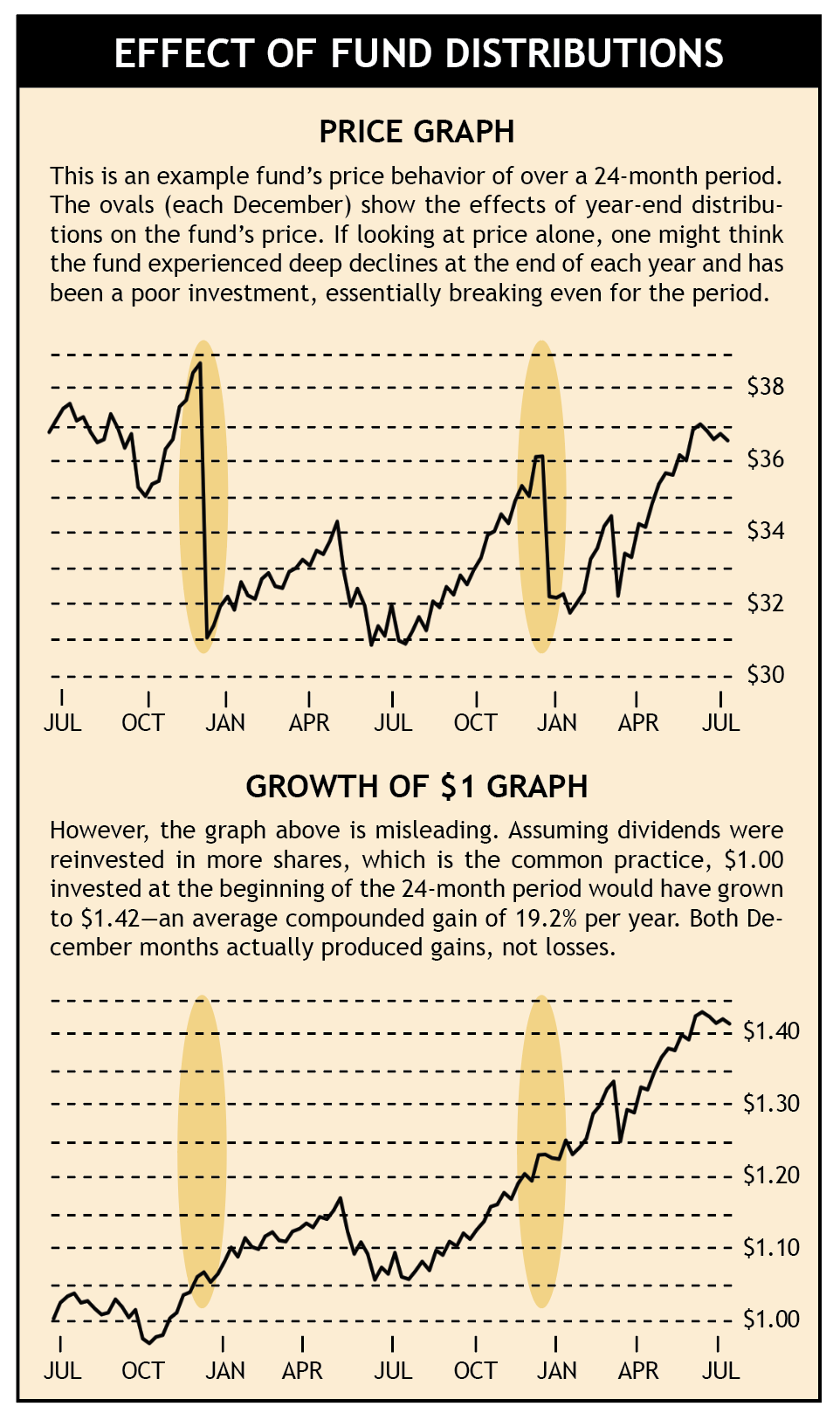

Making distributions is a two-step process. First, the fund company “declares” the amount of the distribution it intends to make and sets aside the appropriate amount of cash needed to write you a check (or deposit money in your account). This has the effect of suddenly lowering the fund’s net asset value (NAV) — one day the money is being counted as part of the fund, and the next day (the day of the declaration), it isn’t.

Click to zoom

This sudden drop in value understandably startles inexperienced investors. They may think the money has been lost! It hasn’t — it’s merely being removed from the fund so it can be paid out to all the fund’s investors. The date this declaration happens is called the “ex-dividend” date. It is the significant date as far as computing one’s tax liability is concerned.

The second step of the distribution process is when the fund actually makes the distribution (either by check or electronic transfer).

Most funds issue distributions at roughly the same time each year (usually in December). Typically, a fund company will notify investors before a distribution, often by publishing the information on the fund’s website. If you’re investing in a taxable account, knowing when a distribution will be declared presents an opportunity for tax savings.

Before making a major purchase of shares in any mutual fund, check the fund company’s website to see (1) if a distribution will be made soon, and (2) if there is an estimate of the amount. (If you don’t find this information on the website, call the company.) If a distribution is scheduled soon, you can avoid its tax impact by waiting to purchase your shares until the day after the distribution.

You also can use this information to move up the sale of any holdings you plan to sell in January for rebalancing reasons. By making a before-distribution sale of positions worth less than your purchase price, you’ll avoid a distribution and also book a loss that may offset other gains on your 2023 tax return. (On the other hand, if you earn a profit — i.e., sell your shares before year’s end for more than you paid for them — you’ll have to pay capital gains tax on your profit by next April 15.)

One cautionary note: A preoccupation with taxes can end up being counterproductive. In investing, a few days can sometimes make a big difference in the price you pay (or receive). Don’t let tax considerations become the overriding factor in your buy/sell decisions.