After reading this introduction-to-DAA article, we suggest also reading The Role of SMI’s Dynamic Asset Allocation Strategy in Light of Current Market Dynamics.

Economic uncertainty is always present, but today’s level of economic uncertainty is unlike anything most of us have experienced.

Decades-long government deficit-spending policies, combined with actions aimed at diffusing the 2008 financial crisis, have created an investing climate that calls for fresh thinking about how to minimize risk without giving up the opportunity for attractive returns.

Stocks, bonds, and gold have had major moves up in recent years, and to many look overpriced. The million-dollar question is this: Where does one invest in a world where everything looks expensive?

We’ve spent a lot of time pondering this in recent months as it relates to one of our foundational investing rules — the older you get, the more your investments should shift away from stocks and toward bonds. This advice has worked beautifully in recent decades as bond yields have fallen from the mid-teens to the low single-digits. As these yields have fallen, bond prices have risen, producing year after year of strong, stable returns.

Over the past two years, however, we’ve been wrestling with a growing unease regarding our traditional stock/bond portfolio framework. Specifically, we’ve grown increasingly concerned that bonds will no longer provide the downside protection — the safe-haven aspect — that investors count on them to provide. With bond prices at all-time highs as a result of the Fed pushing yields to unnatural lows, it’s safe to say the U.S. bond market has never been as overvalued as it is today.

Meanwhile, government borrowing has exploded. Like a rubber band wound tighter and tighter, a limit will eventually be reached. At some point, lenders will look at the massive debt loads that even "credit-worthy" borrowers such as the U.S. government are carrying and demand higher returns (read higher interest rates) for the added risk. Bond yields will eventually rise, and bond prices will eventually fall. The only question is when.

Extreme economic uncertainty

Unfortunately, there’s no such thing as a permanent safe haven in investing. This may come as a surprise to those who have watched money flood into U.S. Treasury bonds at every sign of trouble over the past decade. But we’re reaching the point when government finances become the source of the trouble. That point has arrived in Europe already, and eventually it’s coming here too.

The dominant financial issue of our time is how to deal with the massive amount of debt that governments around the world have amassed. This problem has been building for decades, but the tipping point was reached in the aftermath of 2008’s financial crisis. The pressure is on to reduce these debt loads as a percentage of national income. The question is no longer whether something needs to be done, but how to deal with it and specifically when.

This "deleveraging" process — reducing debt in relation to income — can be attempted in different ways. One way is to cut spending, which is often referred to as "austerity." This has been the approach taken in Europe the past few years. What we’ve learned from watching their efforts is that austerity in the face of an already weak economy is extremely painful. This path has caused dramatic recessions in much of Europe, creating a vicious cycle of lower income, leading to lower tax revenues, leading to even greater government debt. This process is deflationary by nature, meaning prices and wages fall as unemployment rises and demand for goods declines.

Not only does austerity cause great economic pain, it also gets democratically elected politicians voted out of office. This lesson hasn’t been lost on politicians in other countries, as we’ve witnessed in the recent U.S. election and subsequent negotiations regarding the fiscal cliff. Significant spending cuts, in today’s environment, are political suicide. Deflation and recession may well win out anyway, but the powers that be aren’t going to surrender without fighting for more deficit spending.

An alternative approach to stimulating an economy has been what the central banks have been trying to do with their "quantitative easing" programs. To this point, these massive efforts have barely succeeded in keeping the global economy slightly above stall speed. The risk, of course, is that eventually inflation is ignited by these stimulative measures. This hasn’t happened to this point because the deflationary impact of recessions and deleveraging have been overwhelming these otherwise inflationary policies. But this could change, perhaps without much warning, particularly if real economic growth did begin once again. Ironically, governments currently welcome modest inflation, as it helps them repay their debts in cheaper dollars. But this is a dangerous game, as inflation is not easily tamed once unleashed.

Despite the obvious potential risks ahead, it’s surprisingly easy to build an optimistic case, at least for the short-term. By some measures, the U.S. economy appears to be gaining strength and could gain a further boost with a successful resolution to the fiscal cliff. Corporations continue to see record earnings and are extremely well capitalized. And governments have shown an incredible ability to turn what seem to be crises into a long, protracted process instead. Even if a day of reckoning is coming, it still could be years away. The range of potential short-term economic — and investment — outcomes is wider than ever.

As SMI has long maintained, trying to predict the economic future is a losing game. But the stakes have rarely been higher, given the aforementioned valuation extremes in the bond market. If bonds are no longer an adequate safe haven, where else can we turn?

Finding inspiration in the "permanent portfolio"

In the late 1970s, investment adviser Harry Browne began promoting an investing strategy he called the Permanent Portfolio (PP). The main idea behind it is that economic conditions change over time, cycling unpredictably through extremes of prosperity, inflation, recession, and deflation. Each of these phases produces specific investment winners and losers. What you want to own during a recession may well be the opposite of what will perform well during an economic recovery, and so on. Browne’s solution was to divide a portfolio into four equal investments, each highly uncorrelated with the others (meaning they each "march to different drummers"). One-fourth of the portfolio was to be allocated, respectively, to stocks, bonds, gold, and interest-earning short-term investments such as U.S. Treasury bills (referred to as "cash" for short). These were selected because each would excel under a different economic extreme. Thus, the portfolio would always have at least one of the four pieces completely in tune with the current environment. Other than rebalancing periodically, this mix was unchanging, thus the Permanent Portfolio name.

This exceedingly simple approach has performed quite admirably over the past three decades. From 1982-2011, such a portfolio gained roughly 8.2% per year. The S&P 500 gained 11.1% per year but did so with significantly greater volatility and risk. Remember, only 25% of the PP was in stocks. The real virtue of this approach was how little volatility it generated: only two years of negative returns, and the worst (2008) was just -7.2%. This type of smooth ride has appeal to investors who lost more than 30% in stocks during 2008 alone, not to mention three consecutive years of losses between 2000-2002.

We liked the main idea of the PP strategy, but there seemed to be two significant downsides. First, while our goal was to create an approach that appeals to safety-conscious investors, this system was even more conservative than most investors need. Allocating one-fourth of one’s portfolio to cash may have made sense in the late 1970s when that would earn 15% in a money-market fund. Today, cash earns virtually nothing, so permanently fixing a quarter of the portfolio there is a non-starter. If this type of approach was going to work for us, we clearly were going to need to broaden the basket of asset classes beyond the four proposed by Harry Browne.

The second problem has less to do with the portfolio and more to do with human nature. The PP has looked great over the past decade or so, due to stocks being weak while bonds and gold have been soaring. It will always look its best following sharp bear markets in stocks, of which we’ve had two in the past dozen years. But there have been long stretches when the PP lagged the market badly.

We’ve watched investor behavior very closely over the past 22 years, and know how few have the willpower to stick with an approach like this when stocks are crushing the returns of their PP. Stocks gained more than 20% for five straight years from 1995-1999, while the PP earned more than 11% only once! Investors simply don’t stick with systems at times like those — the emotional component is simply too powerful. And yet, the years that followed were exactly the time to embrace the Permanent Portfolio!

Unfortunately, the idea of a static portfolio with no "switching mechanism" would have likely led many to miss the gains of 1995-1999, only to switch to stocks in time to experience the sharp losses of 2000-2002. It seemed that a timing mechanism of some sort would be needed.

The breakthrough: adding a timing element

While a pure application of the PP wasn’t going to work for us, it did spark our thinking about working with "extreme" asset classes that weren’t correlated to each other. The breakthrough came when we started testing what happens when we own only the asset classes showing momentum at that particular time, rather than owning all of them all the time. Sound familiar? It should — we were simply applying an Upgrading-like momentum screen on top of the Permanent Portfolio idea.

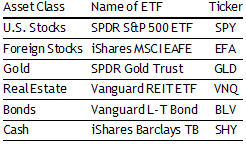

After much testing and many iterations, we emerged with a simple but powerful strategy. Our roster of asset classes eventually expanded to six: the PP’s original four, plus foreign stocks and real estate. Using these six asset classes, we applied a momentum screen at the beginning of each month, identifying the three asset classes we wanted to be in and — perhaps more importantly — the three we wanted to avoid. Each month we re-ran the screen and adjusted our holdings as required.

The results were very impressive.

Winning by not losing

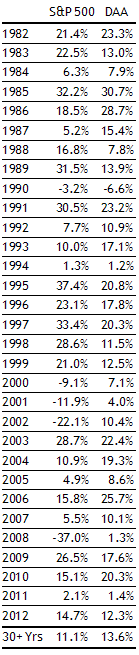

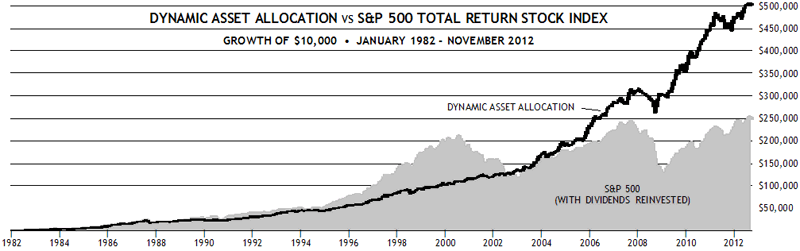

It’s natural to scan the year-by-year results at right and focus on the final results at the bottom of the columns. (These are back-tested results using mechanical formulas. From 1982-2005, the results are those from investing in the asset class benchmarks; from 2006-November 2012, the results are those from investing in the actual ETFs, most of which didn’t exist prior to that time). Yes, our new "Dynamic Asset Allocation" (DAA) strategy’s 13.6% annualized return for the 30 years is significantly better than the S&P 500’s 11.1%. That’s great, but it’s hardly the main story.

Remember, the beginning point of this journey was to find a replacement for bonds as a safe haven for risk-averse investors. If boosting a portfolio’s bond allocation wasn’t going to provide the safety from future market storms that we’ve counted on in the past, we needed something else that would. That’s the real value of this new strategy.

Compare each year’s returns for DAA vs. the S&P 500. A few things should stand out. First, DAA has only had one losing year, a loss of -6.6% in 1990. Now, look specifically at 2000-2002 and 2008. While stocks were plummeting and investors were full of panic and fear, DAA investors would have been breathing easy.

(It’s important to understand that we’re not saying there won’t be any losing years going forward. This is merely the picture of what has happened in the past using the mechanical rules we’ve established for the DAA strategy.)

The key to DAA’s success is winning by not losing. By dramatically reducing losses, the strategy is able to come out ahead in the long run, even though it doesn’t earn as much when stocks are soaring. Most importantly, this is a strategy that risk-averse investors can stick with. That’s crucial, as even the most profitable systems are worthless if investors can’t handle the volatility they experience along the way and end up selling everything out of fear.

DAA outperformed the stock market while being 42% less volatile! That’s a stunning combination. As the chart below illustrates, slow and steady really does win the race!

Click Chart to Enlarge

The good news is this is an extremely simple strategy to implement. That doesn’t mean it will be easy, but we’ll get to that in a moment. Here’s how to implement the strategy.

Nuts and bolts

For each of the six asset classes, a single ETF will be used (as shown in the table below). (For a primer on investing in ETFs, see What’s Not to Like? As Commissions Drop to Zero, Already Low-Cost ETFs Become Even More Attractive.)

Each month, we will post on the SMI website which three ETFs are to be owned for the coming month. This will typically happen on the last day of the month (although if it’s an extremely close call, we may have to wait until the first day of the new month). The idea behind posting the new selections on the last day of the month is to allow the replacing of one asset class with another, if necessary, at nearly the final closing price of the month for each. This would most closely replicate our back-testing process, which used monthly returns.

As a Premium Strategy, only SMI Premium members will have access to these recommendations.

Note that the exact timing of making these changes is not the key to the strategy. Whether you make your trades on the last day of the month or the first day of the new month shouldn’t be a huge performance issue. The key is being in or out of the right asset classes at any given time, not the precise timing of the trades. With that being said, our "official" future results will assume each trade happened at the closing price on the last day of the month.

Once you learn which three ETFs to own for the month, you’ll divide your portfolio (or the portion of the portfolio you’re allocating to DAA) into three equal amounts. Each of the three ETFs will get one-third of the money you have to invest. Much like Upgrading, once you have purchased your first three holdings you’ll check the SMI website each month to see if any of them are being replaced. In many months, you won’t have any trades to make as the three ETFs you currently own continue to be held. When you do have changes to make, it will usually be one ETF at a time as opposed to replacing all three at once. But whenever a change is called for, you’ll simply sell your total holdings of that ETF and use the proceeds to buy the new one.

It’s worth noting that implementing this strategy several years ago prior to ETFs would have been extremely difficult. That’s because DAA investors will occasionally be required to sell an ETF that was purchased just a month earlier. Traditional mutual funds don’t allow such nimble moves; ETFs do with no questions asked. While a small commission will normally be required, many brokers allow some ETFs to be traded commission-free. Those that aren’t free are typically less than $10 per trade at this point, again making this approach more feasible than it would have been in the past.

(A brief note about ETF substitutes: In some cases, substituting one ETF for another may be fine. For example, the iShares S&P 500 ETF, ticker IVV, may be free to trade at your broker, whereas our recommendation, SPY, is not. This substitution is fine, based on the fact that their long-term performance records are extremely similar. But be careful — not all similar-sounding fund names have truly similar performance. Always check longer-term performance at a site such as Morningstar.com before substituting one ETF for another. While the most important thing is being in the right asset class, with ETF commissions being so low these days, you don’t want to be penny-wise and pound-foolish by using an inferior ETF.)

Warning: this won’t be easy

Remember, we promised this new strategy was simple, but that’s not the same thing as easy. This is not a difficult strategy to understand or implement. The instructions are clear and you’ll always know exactly what the strategy is calling for you to do.

However, actually following through and doing it is another matter entirely! The battle will be one of the mind and emotions. Right from the start, some readers will have a difficult time putting one-third of their portfolio into a single security, particularly one like GLD (gold)! At some point, you’ll likely be told to sell an ETF at a loss that you just bought the month before. Are you mentally prepared to do so immediately without questioning the system or the signal?

Before founding SMI, Austin was a professional money manager for more than a decade. During that time, he relied primarily on a market-timing strategy. As a result, we’re very aware of the emotional difficulty many investors have following even the most successful systems. Any system like DAA is going to be wrong from time to time, and require prompt action to quickly reverse positions recently obtained. It won’t always be easy to stick with the system, particularly if you’re the one entering every order and seeing each whipsaw along the way.

Another difficulty arises from the fact there will be times when DAA lags the market for extended periods of time. Consider 1988-1991 or 1995-1999. This will inevitably cause some to drop the strategy, likely right before it would help them the most.

An automated solution is available

None of this diminishes the value of DAA — it merely points to the difficulty some readers will have implementing it for themselves. Visit www.smifund.com for information about a mutual fund that utilizes a similar dynamic allocation approach.

Not an all-or-nothing decision

This new Dynamic Asset Allocation strategy requires readers to check for instructions between issues of the newsletter and make ETF trades on a regular basis. But whereas strategies such as Sector Rotation and the Optional Inflation Hedges are only suitable for a relatively small portion of a reader’s portfolio (no more than 20% of the stock allocation), DAA is different. We feel it can safely be used in as much of your portfolio as you feel comfortable with. It wouldn’t concern us to have someone follow DAA as their primary (or even sole) strategy, given its superior performance and risk profile. The real question isn’t whether DAA is safe, but rather, it’s can you faithfully implement the system’s signals?

This strategy doesn’t fit within either your stock or bond allocation. Because it will steer you in and out of both stocks and bonds when appropriate, the best way to handle it is as a separate portfolio altogether. In other words, we suggest you determine what portion of your total portfolio, if any, to devote to DAA. Set that amount aside, take what’s left and apply your normal asset allocation to that remaining part. For example, someone with a $180,000 portfolio might decide to put $80,000 in DAA and $100,000 in Upgrading. They would take the $80,000 and begin following DAA with that portion. They would then take the remaining $100,000 and divide it using their normal stock/bond allocation.

Conclusion

No one knows what the next few years will hold for the economy, or by extension, for the investment markets. Will we see growth or recession? Inflation or deflation? In the past, planning for these outcomes and the impact each would have on specific types of assets was problematic. Our new Dynamic Asset Allocation strategy frees us from that difficulty, equipping us with a tool that, more often than not, puts us in the right place at the right time. With a risk profile that the most cautious investor can be comfortable with and a track record any investor can get excited about, it’s a welcome breakthrough for such a time as this.