Twelve years ago, SMI announced we were moving away from using momentum to select bond funds within our Fund Upgrading strategy in favor of relying on index funds.

The article announcing this change ended by saying, “We’ve concluded — for now — that indexing bonds is the more profitable route. But we plan to keep looking for a way to add value to the bond side of an Upgrading portfolio, and if we find one, we’ll surely pass it along.”

We’re pleased to report this month that we’ve finally found such a method.

A brief history of SMI bond investing

Understanding SMI’s approach to bond investing in the past will help provide context for the changes we’re introducing for 2015. Prior to 2003, SMI used the same Upgrading approach in bonds that we still use today in stocks. We divided the bond market into risk categories and upgraded monthly between funds in each group using the same momentum formulas we used for stocks.

Over time, we recognized that the extended bull market in bonds was making it very difficult for these upgraded bond portfolios to compete with the ultra-low-cost bond index funds available from Vanguard. We’re nothing if not pragmatic, so we changed course and used the index funds for the next 11 years with good success.

Last January, SMI pivoted back toward actively managed funds in two of our four bond-risk categories. This change was made in an effort to counter the increasing probability of rising interest rates in the future. Said differently, the secular bull market in bonds that had made bond indexing so difficult to beat appeared to be ending, and we thought adding actively managed funds improved our ability to deal with a potentially rising interest rate environment.

However, like some of you, we’ve been disappointed with the results of our bond portfolios in 2014. Based on past interest-rate cycles, we knew lackluster performance of the actively managed Scout funds was a possibility, but hoped it wouldn’t be the case early in our experience with them. We knew going in that these were value-oriented funds, and that approach requires patience to reap the long-term benefits. However, our inability (given the structure we had in place) to pivot from one type of bonds to another as conditions changed proved to be a greater drawback than we anticipated.

New thinking about bond Upgrading

Ultimately, we were driven back to the research lab to continue our quest for a better way to invest in bonds. We began by borrowing from our Dynamic Asset Allocation strategy the notion of applying momentum across risk categories rather than within them as we have always done in Upgrading. We wanted to find out what would happen if we brought together a group of dissimilar bond-fund types and applied a momentum approach to that diverse universe. It works in DAA and in our Sector Rotation strategy — would in work with bonds?

We looked at many iterations of fund universes, momentum formulas, and other tweaks with an eye on (1) keeping the frequency of trading reasonable, and (2) being reasonably confident the system could succeed regardless of whether interest rates rose, fell, or stayed flat.

As a result of this research, we’ve come up with a systematic approach we’re enthused about. The new strategy is simple. One-half of the bond portfolio is divided equally between two familiar Vanguard funds (Short-Term Index and Intermediate-Term Index). These funds provide stability to the bond portfolio. The other half goes into a single “rotating” fund selection that is chosen from a strategically crafted universe of indexed and actively managed bond funds. The two Scout bond funds we introduced last year are part of this universe, along with several other funds and ETFs. Each was specifically chosen to take advantage of — or protect against — a specific economic or inflationary outcome. This is similar to the way we built the asset-class universe for DAA, except our scope here is narrower because we’re trying to cover only the bond landscape.

Importantly, while the backtested results are impressive, we’ve paid particular attention to the fact that the next decade may look nothing like the historical period we’ve tested. Given the relentlessly falling interest rates of the past 30 years, any strategy that relied heavily on long-term bonds would have looked good during that period. But if rates rise in the years to come, that approach will likely perform terribly. We’ve tried to keep this crucial safety emphasis front and center.

Building the new bond portfolio

The two permanent index funds, as well as the recommendation for the rotating fund are listed on the Upgrading Recommendations page. As an example, a reader with $100,000 of bond money to invest would invest $50,000 in the currently recommended rotating fund. The remainder would be split between the Vanguard Short-Term and Intermediate-Term indexes, with $25,000 going into each.

Upgrading significantly boosted returns

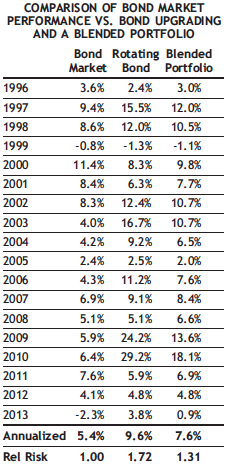

The table nearby shows the backtested results of this approach since 1996. This was as far back as the data was available for the various funds in the bond universe we were testing.

The first column in the table shows the results of a benchmark — Vanguard’s Total Bond Market Index — that is representative of bond-market performance as a whole. The “rotating bond” middle column breaks out the performance of the single fund being Upgraded within this strategy. The final “Blend” column shows the overall performance of our new bond strategy investing 50% of the portfolio in the actively managed rotating fund and 50% in passive bond-index funds.

In looking at the table, it’s clear that the new Upgrading piece (the rotating bond) produced significantly higher returns than either the overall bond market or the blended approach. While this is obviously attractive, we have two reasons for not simply using the rotating bond by itself.

First, along with that boost in performance comes an increase in risk. Note the relative-risk scores of each option (in this case, the risk is relative to the Total Bond Market Index). The Upgrading component was significantly (72%) more volatile than the bond-market index, whereas adding the stabilizing influence of the two index funds reduces the blended-approach risk to a more reasonable 31% more volatile.

(Keep in mind that bonds are much less volatile than stocks, so while 31% and 72% are significant boosts in risk, that’s within the bond-market context. Compared to stocks, all of these approaches look conservative. The bond upgrading component by itself was 62% less volatile than the S&P 500 Index, whereas the blended approach was 71% less volatile than that stock index.)

The second reason to include the index fund base in the blended approach is that our Upgrading component uses only a single fund at a time, and that single fund can sometimes be relatively aggressive. Many SMI readers have large bond portfolios and moving that entire portfolio into a fairly risky bond fund isn’t wise.

Flexibility built in

One challenging aspect of designing a simple bond Upgrading approach is the recognition that SMI serves many different types of bond investors. These range from very conservative readers who want their bond investments to be ultra-safe, to aggressive investors who want to maximize their bond returns and don’t mind taking on some risk to do so. We think the solution we’ve developed is flexible enough to meet both extremes — and everyone in between.

This flexibility comes through the ability readers have to alter their bond-portfolio mix between the relatively conservative base of index funds and the more aggressive Upgrading selection. Our default recommendation is 50% in each, and this is what we’ll base our reported performance on, but each reader can tailor this to his or her personal desires. A conservative bond investor might choose to minimize the Upgrading component while boosting the allocation to the two index funds (e.g., 20% rotating, 80% indexed). In contrast, a more aggressive investor could do the opposite: minimize the indexed pieces and allocate more to the Upgrading selection (e.g., 70% rotating, 30% indexed).

Important notes regarding our methodology

We won’t be able to implement this approach exactly the way it was tested and reported here. We don’t have the ability to backtest intra-month bond prices going back decades, so our only option was to test using monthly data. In other words, our testing assumes we determine the best fund based on month-end data, then used that selection in the very next month.

In practice, we’ll be looking at the performance data for our limited bond universe roughly three days before the new recommendations are released online. We don’t have any reason to believe looking at intra-month vs. end-of-month numbers will make any difference (the managed Upgrading products many SMI readers are familiar with have used intra-month momentum data daily for the better part of 10 years now). Nor do we feel that the brief delay that results from our print/web publishing cycle will be significant. However, even if this approach gives up a little bit of return as a result of these factors, it’s still superior to any other bond-investing approach we’re aware of.

It’s also important to note that our bond Upgrading methodology uses a different momentum calculation than either our stock portfolios or Dynamic Asset Allocation. In other words, the momentum figures you see in the Personal Portfolio Tracker or Fund Performance Rankings are not the numbers on which we are basing these bond Upgrading decisions.

We tested many different formulas and settled on one that seems to offer the best tradeoff between maximizing performance and minimizing trading activity. Other formulas were more profitable, but they required much more active trading than we felt was realistic within the SMI audience. Those approaches may be appropriate for a managed product in the future, but they don’t work for our purposes here. As it is, the formula we are using likely will still lead to a bit more trading than some SMI readers are used to, so those adopting this strategy must be prepared for buying/selling more frequently than with the stock portion of their portfolios.

Conclusion

We think the argument we put forth a year ago — that actively managed funds potentially offer significant advantages in a rising interest-rate environment — still makes a lot of sense. We also continue to think that the low expenses and fully invested posture of Vanguard’s bond-index funds creates a formidable hurdle for active bond managers to beat.

However, with our new approach, we can harness the positive qualities of both active and passive by gaining the ability to move tactically within the bond market as conditions warrant. We’ve not had this flexibility within our bond portfolios before. This leads us to believe the new strategy may be our best approach to investing in bonds yet.