Parents saving for college today enjoy a more attractive college-savings landscape than existed when they were growing up. It was less than 20 years ago, in 1996, that Congress first authorized tax-advantaged “529 plans.” A year later, lawmakers added the option of Education Savings Accounts.

Continuing legislative refinements — along with innovation at the state level — present today’s parents with better ways to save for college than ever before.

With the cost of higher-education rising at two-to-three times the general rate of inflation, students are (not surprisingly) taking on more debt to finance their way through college. The Wall Street Journal reports that the class of 2014 is the most indebted class in history: graduates with student-loan debt owe roughly $33,000 on average. That average debt load has nearly doubled in just the past 15 years. And the proportion of students graduating with debt is increasing as well: in 1994, roughly 50% of students did, whereas that number is greater than 70% today.

Often, this student debt creates an overwhelming burden for young adults trying to make the transition from college to the “real world.” School-related debt payments commonly continue as long as a decade after graduation — and that repayment timeline is getting longer. Keeping up with these debt payments has become increasingly problematic: the Federal Reserve Bank of St. Louis recently released research indicating that a staggering 31.5% of those currently required to make payments on their student loans are at least one month behind. As a reference point, only about 8.5% of all auto loans were recently 30 days delinquent.

Clearly, avoiding school debt as much as possible is a wise thing for a student to do — and parents can help tremendously.

The first key to helping your children keep college debt to a minimum is to start saving early. The longer your time horizon, the more time you have to let the wonder of compound interest work for you. This can make a huge difference in your eventual investment results.

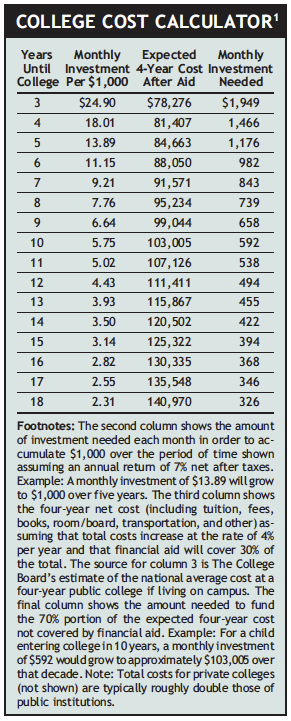

The “College Cost Calculator” at right dramatically illustrates the importance of getting an early start. For example, if you have 14 years before your youngster goes off to college, you need to set aside only $422 per month to build a college fund of $120,502. That $120,502 is expected to represent about 70% of the total (gross) cost for four years of college at a public institution. A target of 70% is reasonable because most students will receive some type of student aid (either from the school itself or from taxpayers) that will cover the balance.

If you get off to a late start, your opportunity for compounding is greatly diminished. If, for example, you have only six years remaining until college arrives for your youngster, you’ll need to invest $982 every month to accumulate the roughly $88,050 you’ll need for your 70% share. (The four-year projected cost is less because eight fewer years of future inflation are factored in. This online College Savings Calculator offers customized savings projections, allowing you to modify variables such as public or private college, rate of cost inflation, expected rate of investment returns, etc.)

Another reason to start early: the earlier you begin, the more risk you can afford to take. This means you can begin with an aggressive portfolio invested 100% in stocks, then later add short-term bonds or money markets as you get closer to the time when you’ll need the money. (The state-sponsored 529 plans we’ll discuss later can automate this process.)

The second key to minimizing student-loan debt is to let your kids know that paying for college is their responsibility as well as yours. Spending for college is no different than any other purchasing decision. Just as most of us can’t afford the most expensive house on the block, most of us can’t afford to foot the entire bill for an expensive education. Even if you can afford it, it’s generally not a wise idea for parents to pay for everything. Expecting your children to responsibly contribute to the cost of their own education is likely to help them value that education all the more. So let your children know that you’ll bear the cost up to a certain amount, but beyond that it’s up to their savings, summer jobs, scholarships, financial aid, and student loans to make up the difference.

Also, it’s best to get your children involved early. Start a college fund for each child (perhaps with previous savings or cash gifts received from grandparents) and as the years go by, have your children contribute to their college nest egg as they receive money for birthdays or generate earnings from yard work, baby-sitting, etc. Not only will this help your children avoid college debt, they’ll be learning a key lesson: disciplined saving is the best approach to meeting future needs.

Three formerly popular options

Prior to the late-1990s, the most popular vehicles for college savings were EE savings bonds and UGMA custodial accounts. The bonds offered tax advantages but were an inferior investment product. The UGMA accounts offered the opposite — better investing options but potential tax drawbacks. Changes to tax laws in the late 1990s and early 2000s eliminated these tradeoffs for most college savers by opening the door to new tax-advantaged options. Going forward, saving for college could be done on a tax-free basis without having to settle for inferior investment products or giving up control of the money invested. As a result, EE bonds and UGMA accounts have fallen dramatically out of favor. Today, it’s the rare family that should consider using them at all.

Another college savings vehicle that once was widely used is the state-sponsored prepaid tuition plan. These plans used to promise that your investment in the plan today would cover tuition at any school in the state no matter what the cost at the time your child enrolls. With the cost of education soaring at twice the rate of inflation, being able to lock in a set price for a college education seemed almost too good to be true. Unfortunately, it was.

Here’s what went wrong. The state sponsors of prepaid plans invested the tuition pre-payments, expecting the upfront money to grow rapidly enough to cover the actual cost of tuition down the road. But the combination of tuition inflation and poor investment returns has left the assets of many state prepaid funds hundreds of millions of dollars below projections. The result is that some investors who paid their children’s tuition ahead of time — and who failed to read the fine print — may not get what they thought they were paying for.

Prepaid plans still exist, but very few states continue to offer them to new savers, and even fewer have guaranteed that prepayments will be fully honored for future tuition. If you’re interested in a prepaid plan and your state doesn’t have one (or if it’s closed), there is an alternative. The Tuition Plan Consortium is a group of private universities that sponsors the Private College 529 (technically, prepaid plans fall under Section 529 of the tax code, though plans commonly referred to as “529 plans” are quite different, as we’ll see in a moment). The consortium sells “certificates” that can be redeemed for a percentage of future tuition at more than 270 member schools. The agreed-on percentage is guaranteed for 30 years from the date of purchase. If your child decides to attend a school that is not part of the consortium, you can request a full refund or roll the value of your certificates over to a state-sponsored plan.

Thankfully, college savers have options other than EE bonds, UGMA accounts, and prepaid plans. The current best options are:

Coverdell ESAs;

Section 529 college-savings plans;

Roth IRAs (surprise!).

Each of the three provides superior tax advantages and flexibility. But each also has some downsides. Let’s look first at the options that are specifically targeted for college savings: Coverdell accounts and 529 plans.

Coverdell Education Savings Account (ESA)

Created in 1997 (as “Education IRAs”) and improved dramatically since, Coverdell ESAs are a compelling savings vehicle for parents whose income falls below the law’s income limits. Parents with an adjusted gross income below $190,000 (filing jointly) may contribute up to $2,000 per child, per year, to a Coverdell ESA. (The contribution ceiling is gradually lowered for taxpayers with modified adjusted gross incomes between $190,000 and $220,000; those with incomes over $220,000 may not contribute to a Coverdell ESA.) Coverdell contributions aren’t deductible, but all earnings grow tax-deferred and will be distributed tax-free if used to pay for a student’s qualified education expenses.

Furthermore, anyone (grandparents, other relatives, friends) can contribute to your child’s Coverdell account as long as they meet the income eligibility rules — but the total contribution from all sources can’t be more than $2,000 a year. It’s possible to set up multiple Coverdell ESAs for the same child, but there’s not much point because, again, the total contribution — for all accounts taken together — is capped at $2,000. A scant $2,000 per year may not seem like much when college costs run into the tens of thousands per year, but a steady stream of $2,000 contributions can add up — if you start early. Assuming an annual earnings rate of 8%, $2,000 per year would accumulate to more than $70,000 over 18 years.

Coverdell accounts have spent much of their life under the threat of legislative repeal or adjustment. Thankfully, that uncertainty appears to be over; under the “fiscal cliff” deal of 2013, the $2,000 contribution amount was made permanent and Coverdell savers were given a significant measure of relief.

A big advantage Coverdells have over Section 529 plans is the flexibility to choose the specific investments you desire (Roth IRAs offer this flexibility as well). This is important for those who want to direct their own investment program, as many SMI readers prefer to do. (Many fund companies or brokerages can set up a Coverdell ESA for you, allowing access to their full range of investment products. There’s even an easy way to apply SMI strategies within a Coverdell ESA.)

Another advantage is that the favored tax treatment of Coverdell earnings extends to cover elementary and secondary school expenses, making Coverdell accounts particularly attractive for parents who want to send their children to a private elementary or high school. The list of qualified expenses is lengthy, and includes obvious items such as tuition and books, as well some non-obvious items, including school uniforms, transportation, computers, and Internet access for the family during the years the beneficiary is in school.

A word about Coverdell ESAs and financial aid: Until 2007, Coverdell accounts that were set up in a child’s name were considered to be assets of the student when it came to calculating financial aid eligibility. Since then, however, assets in a Coverdell account are considered to be assets of the parent(s) for the purposes of calculating financial aid (as long as the student is still a dependent), even if the account is in the child’s name. In most cases, this benefits a student who is seeking financial aid because need-based financial aid formulas weigh a student’s assets much more heavily than parental assets.

Section 529 plans

Over the past two decades, 529 college-savings plans, which offer the same potential tax-free savings for college as Coverdell ESAs, have become the savings vehicle of choice for many families.

Named after Section 529 of the U.S. income-tax code, 529 plans are sponsored by states. (Some state-run college savings plans pre-date Section 529; Ohio launched the first college-savings plan in 1989.) Most states that offer a 529 plan make it available to any U.S. resident, not just residents of the particular state sponsoring the plan. This means you can choose from a broad assortment of plans no matter which state you live in. Moreover, students aren’t required to attend college in the state where their 529-plan money is invested; they can use the assets at any accredited post-secondary institution in the U.S.

Unlike with Coverdell accounts (and Roth IRAs), Congress didn’t create an income limitation for 529 plan contributors. This makes 529s a natural choice for high-income college savers. In addition, while Coverdell ESAs have an annual $2,000 ceiling on contributions, with a 529 plan an individual can contribute up to $14,000 per year to a single beneficiary (that limit being the maximum annual gift tax exclusion). There’s even a way to boost this already high limit: a contribution of up to $70,000 can be made up front, then treated as five consecutive annual contributions for gift-tax purposes. Given that these limits are per contributor, a couple could effectively give double these amounts to a single student. For most people, this means 529 plans offer the ability to save as much as they can without worrying about any ceilings or restrictions.

What’s that? You don’t have $14,000 a year lying around to fund a 529 plan? Don’t be disheartened. Even small amounts invested regularly over an extended period of time can grow surprisingly large. For example, if you can save $125 per month for 18 years and the plan averages returns of 8% per year, you’ll end up with nearly $60,000. That may not cover all of Junior’s college expenses, but it’ll sure put a dent in them.

A final advantage of 529 plans is that the contributor retains control and ownership of the account. This is important on several levels. For starters, it means that the contributor can pull money out of the account at any time and for any purpose, although taxes and a 10% penalty will result from “non-qualified” (i.e., not used for education) distributions. Control by the contributor also allows for flexibility in changing the beneficiary from one child (or grandchild) to another. And perhaps most importantly, contributor control ensures that a child who decides not to go to college doesn’t wind up with an unintended financial windfall (which can happen with a Coverdell ESA). So a 529 plan may not only be a valuable vehicle to help you provide for a college education, saving via a 529 may protect a young person from receiving a large sum that he or she isn’t quite yet spiritually or socially equipped to handle.

Along with the many benefits of 529 plans come a few flaws. The main one is that savers using 529 plans typically are limited to a range of investment options selected by the state—a significant downside for those who want to manage their own portfolios. Also, many 529 plans are “broker-sold,” meaning that investors pay a sales load (it is better to select a “direct sold” plan). While overall expenses continue to fall among 529 plans — some plans now charge less than 0.25% per year — other plans have expenses of 1.5% or even higher. High expenses in a plan where you don’t have the flexibility to upgrade or otherwise implement your own investment strategy can significantly reduce your long-term returns.

Which 529 plan is best for you?

With over 80 state-sponsored college savings plans to choose from (some states have more than one), you need to know which factors are the most important when comparing plans. Obviously, a key component is the average rate of return you can expect. Understanding how various 529 plans invest will give you an idea of what to expect from each type.

Most 529 college-savings plans are managed by mutual fund companies and offer a pre-defined range of investment options. “Age-based” portfolios are designed in a similar manner to target-date funds. They invest mostly in stock funds when the child is young, then shift automatically to safer, interest-earning investments — such as bonds, money market funds, or even FDIC-insured savings — as the child gets closer to college age. Age-based portfolios offer a simple “set it and forget it” way to save. But there’s a huge variation in how aggressive various plans are in their allocations. For example, even in the aggressive track, an 11-year old in New York’s age-based plan is invested only 50% in stocks. Many would argue that simply isn’t aggressive enough.

Thankfully, in recent years many 529 plans have added features that allow for a degree of fine-tuning. In addition to age-based portfolios that shift the asset mix over time, “static” portfolio options are now common. These allow the investor to select a specific mutual fund — or mix of funds — that will remain constant until the investor initiates a change. Many states now offer multiple static choices. Iowa’s 529 plan, for example, has 10 static portfolios in addition to four age-based options. The static portfolios range from an aggressive 100%-stock approach to an almost-no-risk money-market account.

So, even though you forfeit the right to pick from a wide-open array of funds as you can with a Coverdell ESA, a good 529 plan will nonetheless allow you to exercise a significant amount of control over how your money is invested. For instance, among the 13 portfolio options in New York’s direct-sold 529 plan are six Vanguard stock-index funds and two bond-index funds. Account holders can own up to five funds in one account and can specify the percentage to be allocated to each fund. When you consider that you can change investment options once every 12 months and can redirect new contributions at any time, you can see there’s quite a bit of flexibility allowed. (You can also roll an account from a plan in one state to a plan with better investment choices in another state. This can be done only once in any 12-month period, but it’s a relatively simple process.)

Because Congress has permitted the states to be in charge of 529 plans, each state has been doing its own thing — creating different rules for who can participate, how much can be put in, how the money will be invested, etc. All that innovation is a good thing, but having so many plans from which to choose can create confusion for parents. Here, then, are a few suggestions as to which factors are most important when choosing a 529 plan.

Check your own state’s plan first, but also shop around.

Most states offer their residents a state income-tax deduction for contributions made to the state 529 plan. This convinces many parents to look no further. After all, a 5%-9% state tax deduction on every dollar you contribute ought to get your attention. But be aware that other factors, such as the quality of the investment managers, number and type of asset-allocation choices, and the level of management fees, can outweigh the value of a tax deduction. So shop at home first, but be sure to look beyond your state’s borders as well. Check savingforcollege.com for an overview of your state’s plan(s), along with details of plans from other states that may be better than what you can find at home.Look closely at asset-allocation options.

Remember, your most important decision is the allocation between stocks and bonds. As noted earlier, some age-based portfolios offered in 529 plans are quite conservative, moving toward significant bond holdings at an early age. At the opposite end of the risk spectrum, you could take a fully aggressive posture by using a static portfolio to stay 100% in stocks from birth to matriculation. Of course, the best balance is going to be somewhere between these extremes. While you don’t want to be in bonds too early, it is appropriate for the allocation to get more conservative as college age approaches. This helps assure that the account won’t suffer a significant loss just as your student enters college (remember 2008?). Make sure the allocation options offered fit with your desires as to how aggressive you wish to be. One simple approach for those using static portfolios is to invest 100% in stocks until college is five years away, then shift 20% of the account into bonds each year until college arrives.Consider the fees.

Just as with other kinds of mutual fund investing, there will be ongoing operating expenses charged to your account. These fees can vary by more than 1% annually, adding up to a big difference in overall returns over many years.Favor plans with low-cost index fund choices.

As most SMI readers know, we believe it’s possible to beat the market’s returns if you’re able to shift between different investments, as we do in our various strategies. However, in a 529 plan, you don’t have the flexibility to Upgrade or follow monthly signals from a different strategy. The next best thing, then, is to use index funds. Many studies have shown that index funds beat the majority of actively managed funds over time, in large part due to their lower expenses. So our advice in picking a 529 plan is to find one with a solid array of index-fund choices.

Roth IRAs for college?

Although Roth IRAs are designed for retirement, they can be surprisingly useful for college planning. You won’t get tax-free treatment on earnings generated by a Roth if the money is used for college, but you can withdraw your Roth contributions for college expenses without tax or penalty. Ideally, if you use Roth IRA assets to help pay for college, you’ll leave any earnings in the account while withdrawing only from the principal to pay college bills.

One advantage to using a Roth for college savings is that if your daughter gets a hefty scholarship, or decides not to go to college, there’s no need to move your unused savings from a college account to a retirement account. It’ll already be in the most tax-advantaged spot for retirement savings!

This can be a big benefit because Roth contribution limits for individuals (currently $5,500 a year; $6,500 for those age 50 and up) would likely keep you from being able to transfer large sums from a college-specific account into a Roth down the road.

Eligibility to make Roth IRA contributions is limited based on income. For singles, 2015 eligibility begins phasing out when income surpasses $116,000 (AGI). For married couples filing jointly, the phase-out range begins at $183,000.

Here’s another scenario: Let’s suppose you’re blessed with making big bucks by the time the kids go to college and can pay most college bills out of current income. You could then take only minimal withdrawals from your Roth, keeping most of the account intact and growing. This would be helpful because at that point you may no longer be eligible to make contributions to a Roth due to your high income.

As with a 529 plan (and unlike a Coverdell ESA), a Roth IRA allows for some hefty yearly savings. Under current law, a married couple can put $11,000 per year in a Roth ($13,000 if they’re 50 or older). Most families with kids wouldn’t be able to save more than that anyway. Those who do have the wherewithal to sock away more can always put additional money in a Coverdell account or a 529 plan.

But before you decide to go the Roth-for-college route, you need to know there’s a potential downside to using a Roth IRA to save for higher education. It has to do with how IRAs are treated in financial aid formulas. Most such formulas (be aware that formulas may vary from school to school) consider family income as well as family assets. Although parental IRAs aren’t counted as an asset in the formulas, withdrawals from IRAs — even if you’re just withdrawing your contributions, not earnings — are counted as income. So withdrawals from a Roth to pay college expenses will affect your child’s eligibility for need-based aid the following year. Coverdell ESAs and Section 529 plans, in contrast, get the opposite treatment — they count (relatively lightly) as parental assets, but withdrawals don’t count as income. As a result, if you think your child is likely to qualify for financial aid, saving for college via a Coverdell or a 529 plan may be a better choice than doing so via a Roth. At a minimum, try to wait until the child’s final year of school to tap your Roth IRA. At that point, the extra income won’t matter because you’re not trying to qualify for financial aid the following year.

The main reason to consider a Roth for college savings is that the financial road is filled with bumps and unexpected turns. If it ever comes down to an either/or situation between retirement savings or college savings, it’s far better to have a reasonable level of retirement savings than a large college savings fund. Remember, no one will lend you money for retirement; however, Uncle Sam (and private lenders) will happily lend your child money to attend college. Of course, it’s best to avoid such loans if possible, but don’t give up planning wisely for retirement in an attempt to fund college for your children.

Conclusion

The current college-savings landscape offers three solid options. Section 529 savings plans offer the “cleanest” and simplest path to saving for college. They were specifically designed for this goal. Assuming you pick a plan with a solid lineup of low-cost index-fund choices, the only significant drawback to a 529 is that you’re “settling” for an indexing strategy, as opposed to being able to follow a potentially more profitable SMI strategy as you could within a Coverdell ESA or Roth IRA.

For those who prefer to chart their own investment course, fully funding a Roth every year as a joint retirement/college savings account is a good approach. However, as college costs continue to escalate, the financial-aid implications make it reasonable to question if the average family is going to come out ahead using a Roth for college (vs. indexing in a 529 plan). Unfortunately, there’s no easy answer since future returns are unknown, every student’s financial aid situation is different, and many schools use their own financial-aid formulas anyway.

Coverdell ESAs offer the best of both worlds and are our recommendation on the best place for most college savers to start. If you’re able to save more than the $2,000 allowed per child each year in a Coverdell ESA, you can also contribute to a Roth and/or 529 plan. Having a mix of these account types will provide you with the greatest flexibility as your future financial situation becomes clearer.

As we have seen, Coverdell ESAs, 529 plans, and Roth IRAs all have pros and cons. Don’t get so caught up trying to figure out the best option that you postpone making a decision. Any combination of these three choices is better than waiting. Review the options, pray for wisdom and discernment, and get started! Contributing early and often is the best way to make the most of your college-savings program.